The United States Electric Vehicle (EV) charger market is undergoing a transformative period, driven by aggressive federal policy, surging EV adoption rates, and rapid technological advancements. This report provides a detailed analysis of the market’s current state, its competitive landscape, and the strategic direction of its future. The market, valued at approximately USD 5.09 billion in 2024 , is projected to experience robust growth, with a Compound Annual Growth Rate (CAGR) estimated at 30.3% from 2025 to 2030, potentially reaching a valuation of USD 24.07 billion by the end of the decade . This explosive growth is underpinned by massive public investment and a critical shift toward the North American Charging Standard (NACS). Key findings indicate that while Level 2 charging remains the backbone of the public network, DC Fast Charging (DCFC) is the primary focus of public funding and competitive investment, with Tesla’s Supercharger network maintaining a dominant market share in the fast-charging segment.

The global automotive industry is in a decisive transition toward electrification, a movement underpinned by international climate goals and national energy security strategies. In the U.S., this transition is particularly pronounced, with the federal government committing substantial resources to build a ubiquitous and reliable charging infrastructure. The success of the EV market is inextricably linked to the availability and reliability of its charging ecosystem. This report focuses on the Electric Vehicle Supply Equipment (EVSE) market, encompassing Level 1 (L1), Level 2 (L2), and DC Fast Charging (DCFC) technologies, which collectively form the foundation for mass EV adoption.

This research report aims to provide a professional, data-driven assessment of the U.S. EV charger market. The primary objectives are to:

1.Quantify the current market size and forecast its growth trajectory through 2030.

2.Analyze the impact of major federal policies, including the National Electric Vehicle Infrastructure (NEVI) program and the Inflation Reduction Act (IRA).

3.Detail the composition of the installed charging base, segmented by charger type and application.

4.Examine the competitive landscape, focusing on market share, key players, and strategic developments.

5.Evaluate the potential of emerging technologies, such as Vehicle-to-Grid (V2G) and Megawatt Charging Systems (MCS).

The analysis is based on a synthesis of data from authoritative, publicly available sources. Primary data sources include reports and statistics from the U.S. Department of Energy’s Alternative Fuels Data Center (AFDC), the Congressional Research Service (CRS), and technical reports from the National Renewable Energy Laboratory (NREL). Market size and forecast data are drawn from leading market research firms. All factual claims and data points are supported by inline numeric citations, with a comprehensive reference list provided in Section IX.

The U.S. EV charging equipment market is a high-growth sector. The broader Electric Vehicle Supply Equipment (EVSE) market was valued at approximately $7.22 billion in 2023 . The charging infrastructure market specifically is projected to grow from its $5.09 billion 2024 valuation to $24.07 billion by 2030, reflecting a 30.3% CAGR . This forecast is conservative compared to some estimates that project the EVSE market to reach $34.65 billion by 2032 . This rapid expansion is a direct response to the exponential increase in EV sales and the urgent need to address range anxiety among consumers.

1.Accelerating Electric Vehicle Sales and Penetration Rate: The fundamental driver is the sustained growth in EV sales. As of late 2024, the U.S. had approximately 5.4 million EVs on the road , with a market share that continues to climb, creating a proportional demand for charging solutions across all segments (residential, workplace, and public).

2.Government Initiatives and Funding: Federal policy has been instrumental in de-risking investment in charging infrastructure. The Bipartisan Infrastructure Law (BIL), which established the NEVI Formula Program, allocated $5 billion to states to build a national network of high-speed chargers along designated Alternative Fuel Corridors . Furthermore, the Inflation Reduction Act (IRA) provides significant tax credits, such as the 30C Tax Credit, which incentivizes the deployment of commercial charging stations.

3.Corporate Sustainability Goals and Fleet Electrification: Major corporations and logistics companies are committing to fleet electrification to meet sustainability targets. This trend is driving demand for high-capacity, dedicated charging infrastructure at depots and commercial hubs, particularly for medium- and heavy-duty vehicles.

1.Grid Infrastructure Limitations: The rapid deployment of DCFC, especially in rural or high-density urban areas, strains local grid capacity. Significant utility upgrades and make-ready work are often required, adding substantial cost and time to deployment schedules.

2.High Initial Capital Expenditure: The cost of installing DCFC stations, which includes the charger unit, utility service upgrades, and permitting, can be prohibitive for many site hosts, necessitating continued reliance on public subsidies.

3.Permitting and Deployment Complexity: Bureaucratic hurdles, including complex local permitting processes and utility interconnection queues, often delay the activation of new charging sites, slowing the pace of network expansion.

1.Vehicle-to-Grid (V2G) Technology Integration: V2G technology, which allows EVs to send stored energy back to the grid, represents a major opportunity for market growth and grid stabilization. The U.S. V2G technology market is projected to reach USD 25.43 billion by 2034 , driven by pilot programs and the increasing need for flexible energy resources.

2.Software and Energy Management Solutions: The complexity of managing large charging depots and integrating with the grid is creating a booming market for smart charging software, including load management, dynamic pricing, and network optimization platforms.

The U.S. public charging network is heavily skewed toward Level 2 ports, but DCFC ports, while fewer in number, are critical for long-distance travel and high-volume use.

| Charger Type | Total Public Ports (Approx. Q3 2024) | Primary Application | Charging Speed |

| Level 2 (L2) | ~155,162 | Residential, Workplace, Retail, Destination | 20-25 miles of range per hour |

| DC Fast Charging (DCFC) | ~51,193 | Corridor, High-Volume Public, Fleet | 180-300+ miles of range per hour |

| Total Public Ports | ~206,355 |

Note: Data based on CRS calculation using AFDC data, reflecting the approximate composition of the public network as of early 2025 .

The growth of the non-home charging network has been significant, increasing from 151,000 ports in June 2023 to approximately 204,000 in 2024, a 35% increase .

1.Residential: The largest segment by volume, with the majority of EV owners relying on Level 1 or Level 2 home charging. This segment is driven by utility incentives and the convenience of overnight charging.

2.Commercial (Workplace, Retail, Hospitality): Primarily utilizes Level 2 charging to provide convenience charging for employees and customers. This segment is a key focus for Charge Point Operators (CPOs) like ChargePoint.

3.Fleet: A rapidly growing segment, encompassing logistics, transit, and ride-share fleets. This application requires high-power DCFC and increasingly, Megawatt Charging Systems (MCS) for heavy-duty vehicles.

4.Public Access (Corridor Charging): Dominated by DCFC, this segment is the focus of the NEVI program, aiming to establish reliable, high-speed charging along major highways.

The U.S. market is experiencing a profound shift in connector standards:

1.Combined Charging System (CCS): Historically the dominant non-Tesla standard, mandated by the NEVI program for initial funding rounds.

2.North American Charging Standard (NACS): Tesla’s proprietary connector, which was opened for use by other manufacturers. Following announcements from nearly all major automakers, NACS is set to become the de facto standard in North America. Most major automakers will begin adopting NACS for their North American EVs starting with the 2025 model year . This transition will require existing charging networks (e.g., Electrify America, EVgo) to retrofit their stations with NACS connectors by 2025 .

3.CHAdeMO: A Japanese standard, now in decline in the U.S. market, primarily used by older Nissan Leaf models.

The DCFC segment is highly concentrated, with Tesla’s proprietary network holding a commanding lead.

| Company/Network | Approximate DCFC Ports (Late 2025) | Estimated Market Share | Core Business Model |

| Tesla Superchargers | ~34,717 | ~53.0% | CPO/OEM (Proprietary Network) |

| Electrify America | ~5,228 | ~8.0% | CPO (Volkswagen Subsidiary) |

| EVgo | ~4,575 | ~7.0% | CPO (Publicly Traded) |

| ChargePoint | (Lower DCFC share) | (Lower DCFC share) | Hardware/Software Provider (CPO/EMSP) |

Note: Tesla’s share is based on the total number of ports, which is expected to decrease as other networks rapidly expand their DCFC presence and as the NACS transition allows for broader access.

While Tesla dominates DCFC ports, ChargePoint is a leader in the overall charging station count, particularly in the Level 2 and commercial segments, operating primarily as a hardware and software provider (Charge Point Operator, CPO, and Electric Mobility Service Provider, EMSP).

The competitive landscape is defined by consolidation and strategic partnerships:

•NACS Adoption: The widespread adoption of NACS is forcing all major CPOs to invest heavily in retrofitting existing stations and future-proofing new deployments. This move is expected to increase competition and improve the overall user experience.

•Focus on Reliability: Reliability has become a key differentiator. Studies show that networks with higher reliability scores, such as the Tesla Supercharger network, consistently rank highest in customer satisfaction .

•Vertical Integration: Companies like Electrify America (backed by Volkswagen) and Tesla are vertically integrated, controlling both the hardware and the network operations, offering a seamless user experience. Other CPOs are forming deep partnerships with hardware manufacturers and utilities to streamline deployment.

1.Ultra-Fast Charging (350kW+) and Megawatt Charging System (MCS): The market is pivoting toward higher-power charging. The share of ultra-fast chargers (250kW+) has risen sharply to 38% in Q2 2025 . The development of the Megawatt Charging System (MCS), capable of delivering up to 3.75 MW , is crucial for the electrification of heavy-duty trucks and is expected to see standards published between 2024 and 2025 .

2.Wireless Charging Technology: While still nascent, wireless charging offers potential for convenience, particularly in fleet and public transit applications, though standardization and efficiency remain key hurdles.

3.Smart Charging and Load Management: As the number of chargers grows, intelligent software solutions for load management and dynamic power distribution are becoming essential to prevent grid overloads and optimize energy costs.

1.Charging as a Service (CaaS): A model where a single provider manages the entire charging ecosystem—hardware, software, maintenance, and energy costs—for a fixed monthly fee. This reduces the capital expenditure barrier for site hosts.

2.Integration with Renewable Energy Sources: Pairing charging stations with on-site solar generation and battery energy storage systems (BESS) is a growing trend. This mitigates demand charges, improves resilience, and aligns with sustainability goals.

3.Dynamic Pricing: Utilizing real-time energy market data and grid signals to adjust charging prices, encouraging off-peak charging and improving station utilization.

Utilities are transitioning from passive energy suppliers to active partners in the charging ecosystem. Make-Ready programs, where utilities cover the cost of infrastructure upgrades up to the charger connection point, are becoming common. Furthermore, the deployment of battery storage alongside DCFC stations is essential for buffering high-power demand and providing grid services, turning charging sites into distributed energy resources.

The U.S. EV charger market is characterized by rapid, policy-driven growth, a critical shift in connector standards, and intense competition in the DCFC segment. The market is on track to meet, and potentially exceed, deployment targets, primarily due to the substantial financial backing from the NEVI program and IRA tax credits. The transition to NACS is the most significant standardization event, promising to simplify the user experience and accelerate network interoperability. While Tesla holds a dominant position in fast charging, the overall market is diversifying, with Level 2 providers like ChargePoint maintaining a strong foothold in the commercial and destination charging sectors.

The outlook for the U.S. EV charger market is overwhelmingly positive, with a clear path to becoming a multi-billion dollar industry by 2030.

Recommendations:

•For CPOs and Hardware Manufacturers: Prioritize the rapid integration of the NACS connector (SAE J3400) and invest in high-reliability hardware and software. Focus on securing NEVI-compliant sites and exploring V2G capabilities.

•For Utilities: Accelerate the deployment of make-ready programs and invest in grid modernization to accommodate the increasing load from DCFC corridors and fleet depots.

•For Site Hosts: Leverage IRA tax credits and state incentives to deploy charging infrastructure, viewing it as a long-term asset and potential revenue stream through smart charging and V2G participation.

The U.S. EV charger market is moving from an early-stage, fragmented environment to a maturing, standardized, and highly capitalized industry. The primary focus is shifting from simply deploying chargers to ensuring their reliability, interoperability, and integration with the electric grid. The next five years will be defined by the successful execution of federal programs and the technological evolution toward ultra-fast and smart charging solutions.

[1] Grand View Research. U.S. Electric Vehicle Charging Infrastructure Market | Report 2030. [URL:

[3] EV Charging Stations. There Are Now Over 65000 Public DC Fast-Charging Stalls in the US. [URL:

[4] Paren. US EV Fast Charging — Q2 2025. [URL:

[5] CharIN. How to prepare for the Megawatt Charging System. [URL:

[6] IEA. Electric vehicle charging – Global EV Outlook 2025. [URL:

[7] Mesago. Ultra-fast DC charging stations are the backbone of future e-mobility. [URL:

[8] Autoweek. Here’s When These 16 Automakers Will Switch to Tesla’s NACS. [URL:

[9] Custom Market Insights. US Electric Vehicle Supply Equipment Market 2024–2033. [URL:

[10] NYSERDA. National Electric Vehicle Infrastructure (NEVI ) Program. [URL:

[11] Autos Innovate. Get Connected EV Quarterly Report 2024 Q3. [URL:

[12] J.D. Power. 2025 U.S. Electric Vehicle Experience (EVX ) Public Charging Study. [URL:

[13] The ICCT. U.S. charging infrastructure deployment through 2024. [URL:

[14] NREL. The Dawn of Electric Trucking Calls for High-Power Charging. [URL:

[15] CRS. EV Charging Infrastructure: Frequently Asked Questions. [URL:

Lorem Ipsum is simply dummy text of the printing and typesetting industry

Lectron NEMA 14-50 Socket Splitter – Smart Power Sharing for Level 2 EV Charging & Home Appliances The Lectron NEMA...

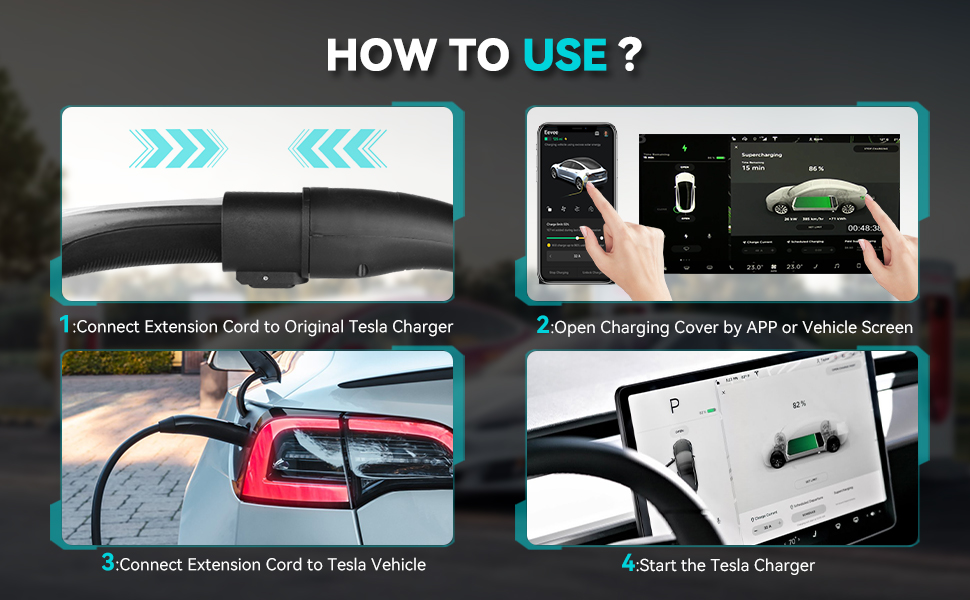

Tesla Extension Cord 21ft (NACS) – 50A / 12kW High-Power EV Charging Extension for Model 3 / Y / S...

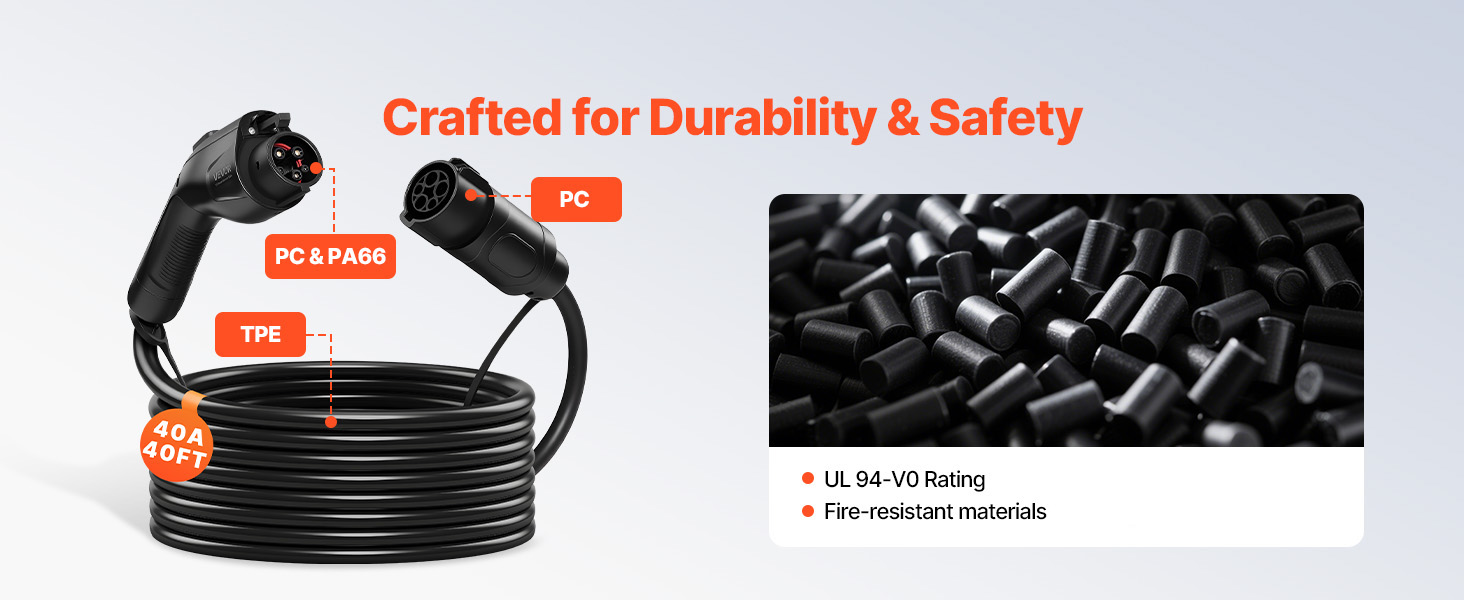

VEVOR J1772 EV Charger Extension Cable – 40A, 40ft, Level 1 & Level 2 (120V–240V) 4 The VEVOR EV Charger...