Should You Start an EV Charging Station Business? Business Models, Profitability & Investment Guide

Electric vehicle (EV) charging is no longer just a “tech trend” – it is becoming critical infrastructure.

If you are wondering whether to start, own, or invest in EV charging stations, this guide walks through

the real business models, how stations make money, risks, and what to expect in terms of profitability.

Quick Answer – Is EV Charging a Good Business?

- Yes, but it is capital-intensive and usually long-term payback, not a quick-cash business.

- Best results come when charging adds value to an existing business (retail, real estate, fleets).

- Revenue comes from energy sales, parking, demand charges, advertising, and partnerships.

Recommended First Step

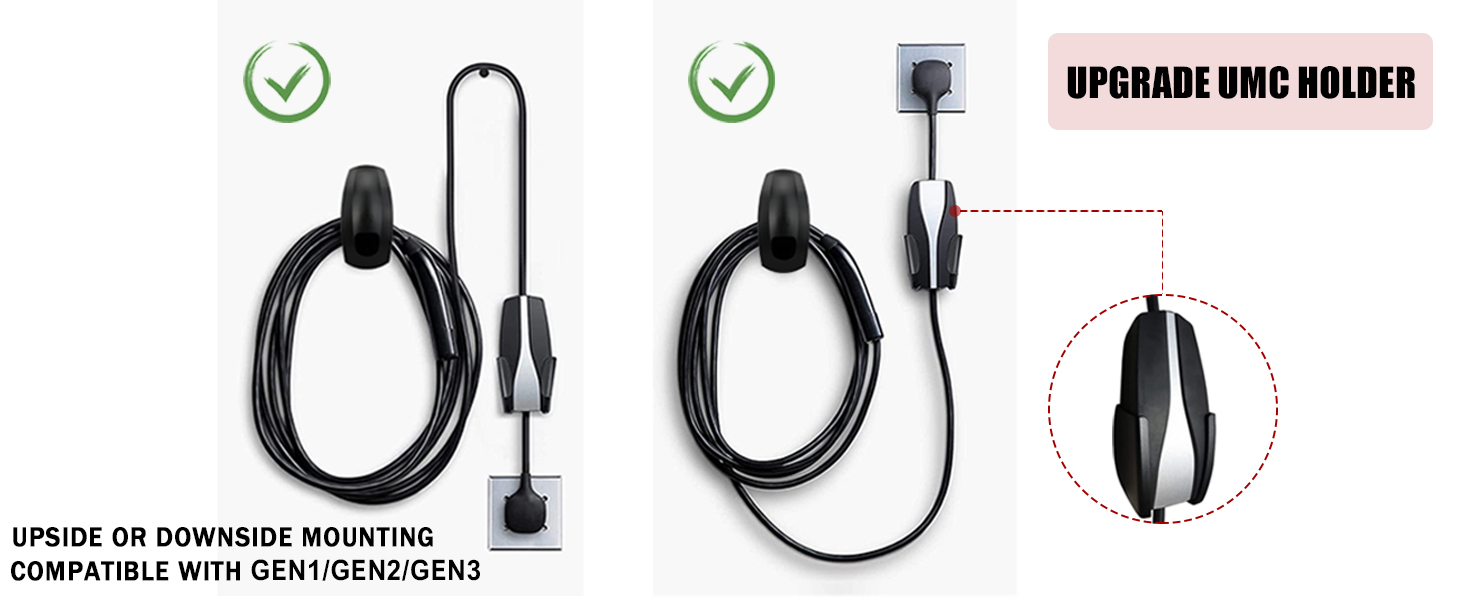

Before you invest in a full site, it’s wise to understand hardware, power limits and user behavior.

Many small operators start by learning with a smart Level 2 charger at home or a pilot location.

Explore a Smart Level 2 Charger on Amazon

Affiliate note: if you purchase via this link, we may earn a small commission at no extra cost to you.

01 · Should I start an EV charging station business?

Should I Start a Business of Electric Vehicle Charging Stations?

Should-I-start-a-business-of-electric-vehicle-charging-stations

You can build a profitable EV charging business, but only if you treat it like infrastructure and real estate,

not like selling a gadget. Successful operators usually have at least one of these advantages:

- They already control great locations – malls, parking lots, hotels, office buildings, fleets.

- They can get good power capacity (240V for Level 2, 480V 3-phase for DC fast) at reasonable cost.

- They qualify for local or federal incentives that reduce upfront capex.

- They design a multi-revenue model: energy + parking + retail uplift + advertising + data, etc.

If you have none of these advantages yet, it may be better to start smaller:

- Install smart Level 2 chargers at your own property or small rental lots.

- Partner with existing property owners rather than buying land yourself.

- Use a proven hardware brand (for example, commercial-grade Level 2 hardware like those on Amazon) and a

reputable software/network platform.

02 · How charging stations make money

How Do Electric Car Charging Stations Make Money?

How-do-electric-car-charging-stations-make-money

EV charging stations typically use a portfolio of revenue streams rather than just the price per kWh:

- Energy sales

You charge drivers by:

- kWh (where regulations allow per-kWh billing)

- Time (per minute or per hour)

- Session fee or connection fee

- Parking & dwell-time revenue

In malls, hotels, airports, and offices, the value is in keeping customers on site longer, which boosts

spending in retail or food & beverage.

- Premium services

Reserved spots, guaranteed availability, or “valet charging” can carry higher fees.

- Advertising & sponsorship

Screen-based chargers and branded stations (e.g., at supermarkets) can sell ad space or sponsorship.

- Data & partnerships

Usage data, loyalty programs, and app partnerships can create indirect value.

What Is the Business Model Behind Electric Vehicle Charging Stations?

What-is-the-business-model-behind-electric-vehicle-charging-stations

Most charging businesses fall into one or more of these models:

- Owner–operator: You own the hardware, pay for electricity, set pricing, and keep the revenue.

- Host–partner: Property owner gives space and power; a charging company installs and runs the hardware, and you share revenue.

- Network-as-a-Service (NaaS): You own hardware, but pay a monthly fee for software, billing, and customer support.

- Franchise / white-label: You use a known brand or network; they provide hardware and platform, you provide the site and capex or lease payments.

03 · Rental / small site operations

What Is It Like to Run a Rental EV Charging Station and How Profitable Is It?

What-is-it-like-to-run-a-rental-electric-vehicle-charging-station-and-how-profitable-is-it

A “rental” charging station (for example, in a small apartment car park or leased commercial lot) is essentially

a mini utility:

- You pay for the hardware, installation, and ongoing electricity.

- You collect revenue from drivers, tenants, or fleet customers.

- You handle support, repairs, and software fees (if using a network platform).

Profitability depends on:

- Utilization (how many hours per day the chargers are in use)

- Spread between what you pay per kWh and what you charge users

- Capex & incentives: grants or rebates can dramatically improve ROI

- Tariff design: avoiding high demand charges and using off-peak energy where possible

In early years, utilization may be low; many operators accept a 5–10 year payback horizon, similar to solar or other infrastructure,

rather than expecting quick retail-style profits.

04 · Profitability vs gas stations

How Profitable Are EV Charging Stations Compared to Gas Stations?

What-is-the-profitability-of-electric-vehicle-charging-stations-compared-to-gasoline-based-filling-stations-What-are-the-benefits-of-investing-in-electric-vehicle-charging-stations

EV Charging vs Gasoline Stations – Different Economics

- Gas stations: High daily throughput, thin fuel margins, but strong shop, food, and services profits.

- EV charging: Lower daily energy throughput (for now), but:

- Better suited to destinations (work, shopping, hotels) instead of quick refuel-only stops.

- Can be paired with parking, retail, real estate value uplift.

Benefits of Investing in EV Charging Stations

- Future-proofing a property: tenants and customers increasingly expect EV charging.

- Regulatory tailwinds: some regions offer grants, tax credits, and zoning benefits.

- ESG and branding: visible sustainability investment that supports corporate ESG goals.

- Optional upside: as EV adoption rises, utilization and revenue can grow without additional land cost.

05 · US market & future outlook

Is It Profitable to Install, Own, and Run EV Charging Stations in the United States?

Is-it-profitable-to-install-own-and-run-electric-vehicle-charging-stations-in-the-United-States

In the U.S., profitability depends heavily on location, power costs, incentives, and business model.

High-traffic sites near highways or dense urban areas with limited home charging can perform well.

Rural or low-traffic sites may struggle unless backed by grants or a broader strategy (e.g., tourism or branding).

Many U.S. operators treat EV charging as:

- A value-add amenity (for apartments, offices, hotels) rather than a standalone profit center, or

- A long-term infrastructure play with lower returns in early years but strong upside as EV penetration grows.

Will an Electric Vehicle Charging Station Business Work in the Future?

Will-an-electric-vehicle-charging-station-business-work-in-the-future

Long term, the direction is clear: more EVs → more charging infrastructure. However, not all sites will win.

The best positioned businesses will:

- Secure strategic locations (commuting corridors, dense housing, premium destinations).

- Offer a good user experience (reliable hardware, clear pricing, easy-to-use apps).

- Integrate smart charging to manage grid limits and energy costs.

- Use multiple revenue streams, not just per-kWh pricing.

06 · Stocks, investing & capital

Is It a Good Time to Invest in EV Charging Station Stocks?

Is-it-a-good-time-to-invest-in-electric-vehicle-charging-station-stocks

EV charging stocks are typically high-volatility, growth-oriented investments. They are influenced by:

- EV adoption rates and government policy

- Competition and consolidation in the charging market

- Capital intensity and path to profitability for each company

If you consider these stocks, approach them as long-term, high-risk positions rather than guaranteed winners.

Diversification and independent financial advice are strongly recommended.

How Do I Invest in Electric Vehicle Charging Stations?

How-do-I-invest-in-electric-vehicle-charging-stations

You have several ways to gain exposure to EV charging as a business or investor:

- Own and operate physical chargers

Buy hardware (for example, commercial-grade Level 2 units similar to those available on Amazon), secure sites,

pay for installation, and earn from energy and parking revenue.

- Partner with networks

Become a site host for a major charging network. You provide the site and power; they provide hardware, software

and sometimes capital, in exchange for a revenue share.

- Invest in public equities

Buy shares of companies involved in charging networks, hardware, software, or related infrastructure (subject to your own research and risk tolerance).

- Indirect exposure

Invest in utilities, grid companies, real estate, or infrastructure funds that benefit from EV charging build-out.

Practical Starting Point

If you are new to the space, a simple, low-risk way to learn is to install a smart Level 2 charger at home

or at a rental property, and monitor:

- Actual energy usage and peak demand

- User behavior and charging times

- Impact on electricity bills

View a Smart Level 2 Charger Example

07 · Franchises & partnerships

Are Companies Offering Franchises for EV Charging Stations?

Are-companies-offering-franchises-for-electric-vehicles-charging-stations

Yes, there are companies that offer franchise-like or white-label models for EV charging. The exact structure varies:

- Some provide turnkey hardware + software + brand, you provide the location and capital.

- Some act more like network partners – they handle billing and app access, you keep more local control.

- Others sell hardware and let you choose your own software/network provider.

When evaluating a franchise or network partnership, look at:

- Upfront fees and hardware costs

- Revenue share, software fees, and minimum commitments

- Contract length and termination clauses

- Brand strength, app user base, and technical support quality

08 · Summary

Is an EV Charging Station Business Right for You?

In summary:

- EV charging can be a viable business or investment, but it is infrastructure, not a quick-profit retail play.

- The best opportunities are where you already control valuable locations (real estate, fleets, parking).

- Use multiple revenue streams and think long term (5–10 years), not quarters.

- Start small, learn with pilot sites or smart Level 2 chargers, and scale once you understand your local demand and grid limits.

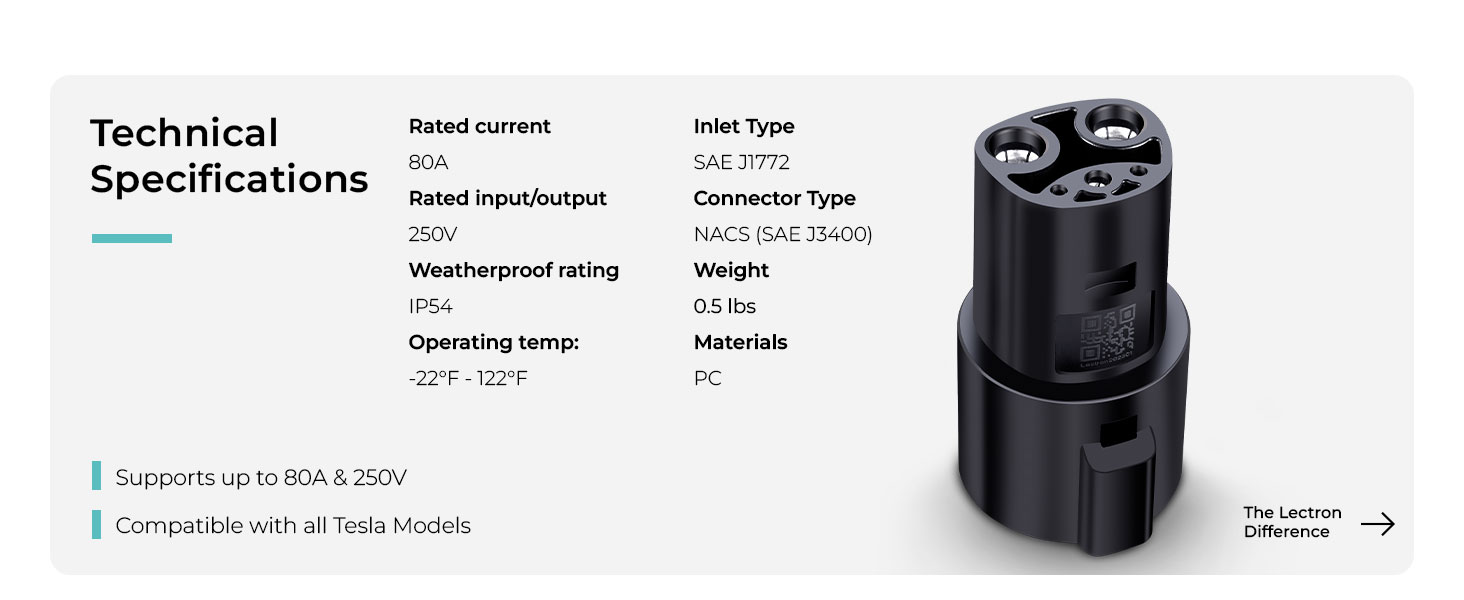

If you are serious about entering the space, combine technical knowledge (hardware, power, connectors like J1772/NACS)

with solid financial planning and realistic assumptions about utilization. That mix is what separates

sustainable EV charging businesses from expensive experiments.