To monetize a private EV charger, you typically need: (1) a smart charger or energy meter capable of user authentication and billing, (2) connection to a charging management platform (OCPP-based networks such as ChargePoint, Zap-Map, or local aggregators), (3) local zoning and electrical compliance approval, and (4) appropriate insurance coverage. Most hosts earn revenue through per-kWh pricing, time-based fees, or parking bundles. Utility demand charges and tax obligations must be factored into pricing.

Responsibility is shared. The UK Government (via the Department for Transport and the Office for Zero Emission Vehicles) sets national policy and funding schemes. Local councils oversee public installations and planning approval. Private operators (e.g., BP Pulse, Gridserve, Pod Point) own and operate most chargers, while Distribution Network Operators (DNOs) manage grid connections and capacity.

Nigeria’s EV charging ecosystem is emerging. Key players include private energy and mobility firms such as Sterling Bank–supported charging pilots, OEM-backed initiatives, and renewable-focused startups. Most deployments remain private or fleet-based, with regulatory oversight coming from the Nigerian Electricity Regulatory Commission (NERC).

In Ireland, certified installers are commonly listed through the Sustainable Energy Authority of Ireland (SEAI). SEAI maintains an approved contractor list for home and commercial EV charger grants. Major electrical contractors and utilities also offer turnkey installation services.

EV charger installation in Dubai requires approval from the Dubai Electricity and Water Authority (DEWA). Installations must be completed by DEWA-approved contractors, comply with UAE electrical codes, and may require landlord or building management consent. Public chargers are often deployed under the “Green Charger” initiative.

Governments play a central role by setting standards, offering incentives, funding public infrastructure, ensuring grid readiness, and regulating safety. Typical interventions include tax credits, grants, building code mandates, interoperability requirements, and national charging corridor programs.

GST/VAT treatment varies by country. In India, EV chargers are generally taxed at 5% GST to encourage adoption. In the UK and EU, VAT typically applies at the standard rate for equipment, while electricity supplied for charging may be taxed differently. Businesses should verify local tax rules and eligibility for exemptions or rebates.

Lorem Ipsum is simply dummy text of the printing and typesetting industry

Lectron NEMA 14-50 Socket Splitter – Smart Power Sharing for Level 2 EV Charging & Home Appliances The Lectron NEMA...

Tesla Extension Cord 21ft (NACS) – 50A / 12kW High-Power EV Charging Extension for Model 3 / Y / S...

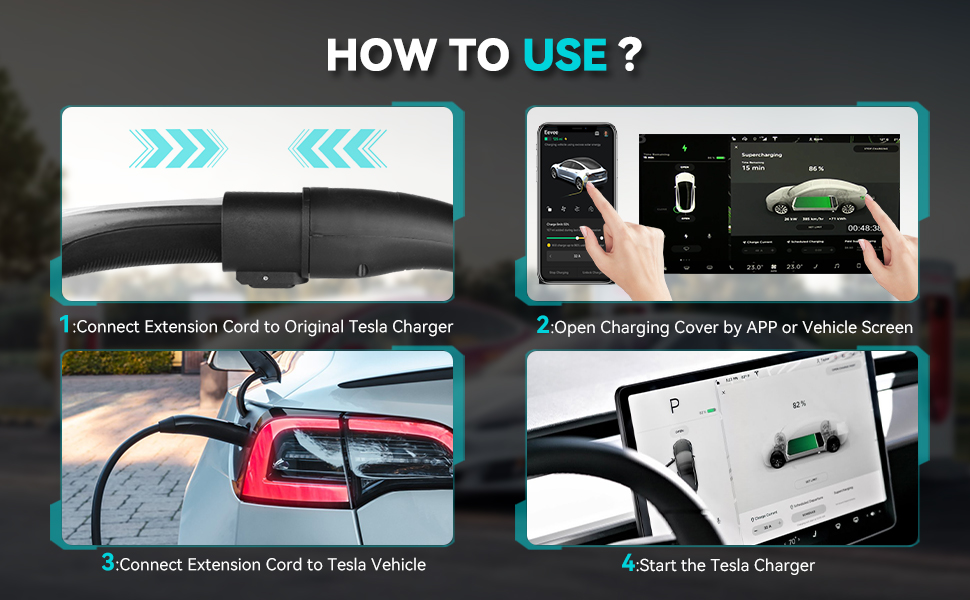

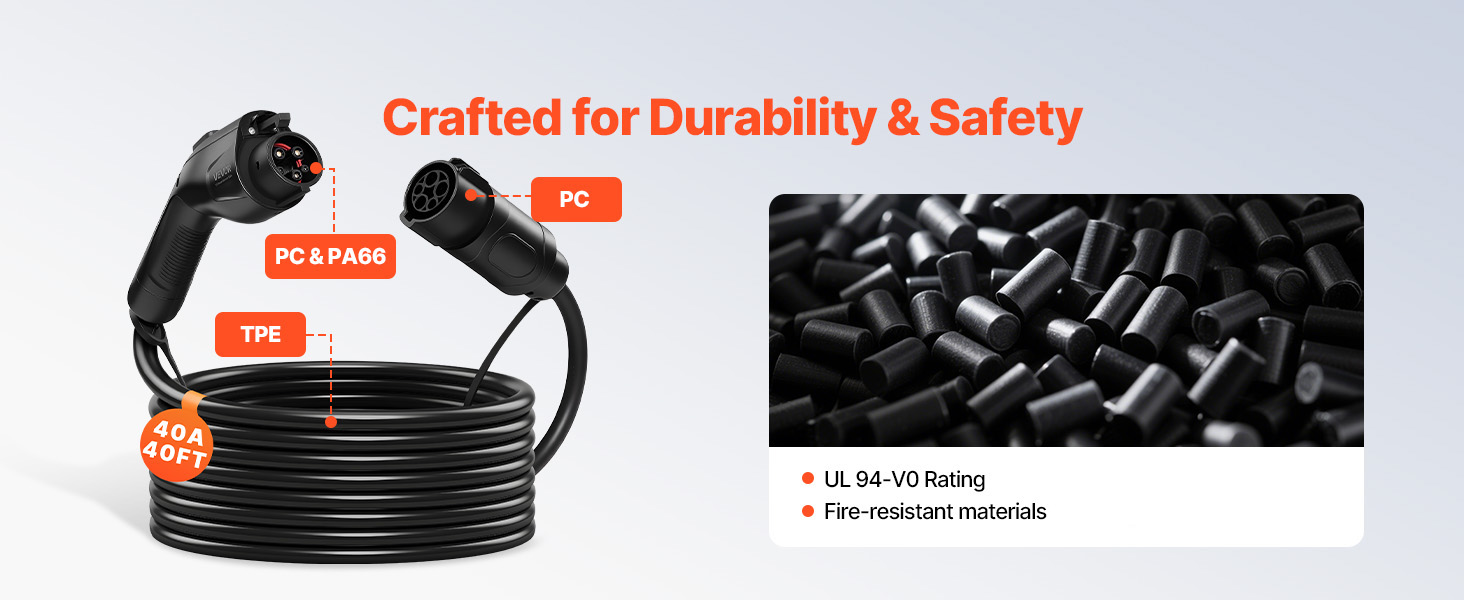

VEVOR J1772 EV Charger Extension Cable – 40A, 40ft, Level 1 & Level 2 (120V–240V) 4 The VEVOR EV Charger...