This report analyzes the U.S. electric vehicle (EV) charging ecosystem, focusing on three critical dimensions: the accelerated adoption of the North American Charging Standard (NACS), advancements in charging technology, and the interplay between vehicle models and infrastructure development. With Tesla holding a 43% market share, NACS has emerged as the dominant standard, driving industry-wide alignment among automakers and charging network operators. Technological breakthroughs have led to the deployment of ultra-fast chargers with power outputs exceeding 350 kW, significantly reducing charging times and enhancing user convenience. Concurrently, innovative solutions like wireless charging are undergoing real-world validation, as demonstrated by the Gothenburg taxi trials, which highlight the potential for seamless integration into urban mobility systems. The analysis reveals a dynamic landscape where infrastructure expansion is increasingly synchronized with EV adoption rates, though challenges remain in balancing technological innovation with equitable access and grid stability. This synthesis of market trends, technological capabilities, and infrastructure development provides a comprehensive overview of the current state and future trajectory of the U.S. EV charging sector.

Key Metrics

The rapid electrification of the transportation sector represents a critical frontier in global decarbonization efforts, with electric vehicle (EV) charging infrastructure emerging as both a catalyst and bottleneck for mass adoption. The market momentum is underscored by Tesla’s dominant 43% share of the U.S. EV market, reflecting strong consumer demand for battery-electric vehicles that now requires commensurate infrastructure development to sustain growth trajectories. Despite this progress, significant gaps persist in the charging ecosystem: the U.S. Department of Energy (DOE) reported approximately 200,000 public charging ports as of 2024, a figure that falls short of the estimated 1.2 million units needed by 2030 to support projected EV adoption rates, according to BloombergNEF analysis.

Policy interventions have accelerated to address this disparity, most notably through the National Electric Vehicle Infrastructure (NEVI) Formula Program, which allocates $5 billion in federal funding to deploy a coast-to-coast charging network. This initiative, coupled with private sector investments exceeding $7 billion in 2023 alone, signals a transformative period for charging infrastructure development. The International Energy Agency (IEA) projects that global EV sales will reach 35% of all passenger vehicle sales by 2030, a forecast that hinges on the availability of reliable, high-performance charging solutions across urban and rural landscapes.

Against this backdrop, the technical complexity of charging systems presents multifaceted challenges. Current infrastructure encompasses a fragmented landscape of charger types—from Level 1 AC chargers (1.4–2.3 kW) suitable for overnight residential use to ultra-fast DC chargers (350+ kW) capable of delivering 200 miles of range in under 15 minutes—each with distinct technical requirements and user applications. Standards further complicate this ecosystem, with competing protocols such as CCS (Combined Charging System), NACS (North American Charging Standard), and CHAdeMO creating interoperability barriers that hinder user experience and infrastructure efficiency.

This analysis addresses the critical need for a comprehensive understanding of U.S. EV charging technologies by examining four interconnected dimensions: the technical characteristics and deployment scenarios of existing charger types; the evolution of standards and their implications for cross-compatibility; the alignment between vehicle battery technologies and charging infrastructure capabilities; and emerging innovations such as solid-state battery integration, bidirectional charging, and smart grid integration. By synthesizing these elements, the report aims to provide actionable insights for policymakers, industry stakeholders, and technology developers navigating the transition to a fully electrified transportation system.

Key Significance

The intersection of market demand, policy support, and technological innovation positions EV charging infrastructure as a linchpin of the energy transition. With BloombergNEF projecting $1.6 trillion in global EV infrastructure investments by 2040, understanding the technical and regulatory landscape becomes imperative for stakeholders seeking to capitalize on this growth while addressing persistent challenges of accessibility, affordability, and sustainability.

The classification of U.S. EV chargers is primarily based on charging levels, each with distinct technical specifications and application scenarios. According to authoritative sources such as the U.S. Department of Energy (DOE) and SAE International, the main charger types currently in use include those based on SAE J1772, CCS1, and NACS standards, which differ significantly in voltage/current ratings and functional designs.

Level 1 chargers typically operate at an AC voltage of 120 V with a current rating of 12 – 16 A, resulting in a power output of approximately 1.4 – 2.4 kW. These chargers are mainly designed for home use, utilizing standard household electrical outlets. Due to their relatively low power, they are suitable for overnight charging, providing a driving range of about 12 – 20 miles per hour of charging. Their simplicity and wide availability make them a common choice for residential EV owners, although their slow charging speed limits their use in public settings.

Level 2 chargers operate at an AC voltage of 240 V (single – phase) or 480 V (three – phase), with current ratings ranging from 16 A to 80 A, leading to power outputs between 3.3 kW and 19.2 kW (single – phase) or higher (three – phase). They are widely used in both home and public environments. In home settings, Level 2 chargers can provide a driving range of 10 – 60 miles per hour of charging, significantly faster than Level 1. Public Level 2 chargers are commonly found in workplaces, retail parking lots, and residential complexes. Workplace chargers often cater to employees who can charge their vehicles during working hours, while retail chargers are designed for short – term charging during shopping trips. The SAE J1772 standard is widely adopted for Level 2 charging, featuring a five – pin design that enables safe and efficient AC power transfer.

Key Features of SAE J1772 Five – Pin Design

DC Fast Chargers bypass the vehicle’s on – board charger and directly supply DC power to the battery, enabling much faster charging. Common DCFC standards in the U.S. include CCS1 and NACS. CCS1 (Combined Charging System 1) combines the SAE J1772 AC connector with two additional DC pins, forming a combo structure. This design allows for both AC and DC charging using the same connector. DCFC voltage typically ranges from 200 V to 1000 V or higher, with current ratings up to 500 A or more, resulting in power outputs that can exceed 350 kW. These chargers are primarily deployed in public locations such as highway rest stops, gas stations, and dedicated charging stations, providing a driving range of 60 – 100 miles or more in just 10 – 15 minutes of charging, making them ideal for long – distance travel.

According to DOE’s 2024 public charger distribution data, Level 2 chargers account for 60% of the market, while DCFCs make up the remaining 40%. This distribution reflects the current demand for both convenient, slower charging in daily environments (such as workplaces and retail areas) and fast charging for long – distance travel. The continued growth in EV adoption is expected to drive further expansion and diversification of the charger market, with advancements in charging technologies and standardization efforts likely to shape future trends.

The SAE J1772 and CCS1 standards play crucial roles in the U.S. EV charging infrastructure. The five – pin design of SAE J1772 ensures reliable AC charging, while the combo structure of CCS1 integrates AC and DC charging capabilities, enhancing the versatility of the charging network. As the industry evolves, the adoption of NACS (North American Charging Standard) is also gaining momentum, with major automakers and charging network operators supporting this standard, which is expected to further streamline the charging experience for EV users in the U.S.

The evolution of electric vehicle (EV) charging interface standards in the U.S. has been marked by a transition from fragmented legacy systems to a unified technical framework, with significant implications for interoperability, infrastructure development, and consumer adoption. This chronological progression reflects both technical advancements and market-driven standardization efforts, culminating in the adoption of the North American Charging Standard (NACS) as the SAE J3400 standard, a milestone supported by authoritative data from the U.S. Department of Energy (DOE) and SAE International.

Prior to the widespread adoption of NACS, the U.S. market was characterized by two primary charging interface standards: the Combined Charging System (CCS1) and CHAdeMO. CCS1, developed as a collaborative effort by European and American automakers, faced criticism for its bulkiness, with a connector design that increased manufacturing complexity and user handling difficulty. This physical limitation became more pronounced as EVs advanced toward higher power requirements, creating practical challenges for both vehicle integration and charging station deployment.

CHAdeMO, originally developed by Japanese automakers, suffered from gradual obsolescence due to its limited adoption beyond Asian markets and slower adaptation to evolving power delivery needs. By the early 2020s, its market share in the U.S. had declined significantly, with major automakers shifting focus to more versatile standards, leaving CHAdeMO primarily supported in older EV models and niche applications.

The introduction of NACS represented a paradigm shift in charging interface design, addressing the technical shortcomings of legacy standards through three key innovations: smaller form factor, higher power delivery capability, and backward compatibility. These advantages positioned NACS as a more user-friendly and future-oriented solution, prompting its formal adoption as SAE J3400 in 2023—a critical milestone validated by data from SAE International and the U.S. Department of Energy (DOE).

SAE J3400’s technical specifications further solidified NACS’ role as a future-proof standard. Notably, the standard supports 1000V DC charging, enabling power levels exceeding 350kW—capabilities that align with the next generation of EV batteries and address growing consumer demand for faster charging times. This technical foundation ensures NACS can accommodate projected advancements in EV technology over the next decade, reducing the risk of premature standardization obsolescence.

The transition to NACS has accelerated rapidly, with BloombergNEF forecasting that 70% of new U.S. EVs will feature NACS ports by 2027. This shift is driven by both automaker adoption—including commitments from Ford, General Motors, and Tesla—and infrastructure investments, as charging network operators like ChargePoint and Electrify America begin deploying NACS-compatible stations.

Despite this momentum, interoperability remains a critical challenge, particularly for existing EVs equipped with CCS1 ports. To address this, the DOE has highlighted the availability of CCS1-to-NACS adapters as a transitional solution, with data indicating that major adapter manufacturers have achieved production scale to meet near-term demand. However, long-term interoperability will require continued collaboration between automakers, charging networks, and standardization bodies to ensure seamless user experiences across vehicle models and charging infrastructure.

Key Takeaway: The standardization of NACS as SAE J3400 marks a pivotal moment in the U.S. EV ecosystem, resolving the fragmentation of legacy interfaces while establishing a technical foundation for next-generation charging. As market adoption accelerates, addressing interoperability through adapter availability and infrastructure upgrades will be essential to ensuring a smooth transition for consumers and maintaining momentum toward widespread EV adoption.

The evolution of charging interface standards in the U.S. thus reflects a dynamic interplay between technical innovation, market forces, and regulatory coordination. By aligning around SAE J3400, stakeholders have taken a significant step toward a unified charging infrastructure, though ongoing efforts to address interoperability and scale deployment will determine the pace of this transformation.

The U.S. electric vehicle market exhibits distinct competitive dynamics, with Tesla maintaining a dominant position of 43% market share, significantly outpacing legacy original equipment manufacturers (OEMs). This market structure is shaped by a combination of vehicle specifications, charger compatibility, consumer preferences, and affordability factors, as evidenced by key models such as the Tesla Model Y/3, Chevrolet Equinox EV, and Ford Mustang Mach-E.

Tesla’s Model Y, which ranked #1 in Car and Driver’s 2025 rankings, exemplifies the brand’s competitive edge. While specific battery capacity and charging rate details for the 2025 Model Y are integral to its appeal, the model’s compatibility with Tesla’s proprietary Supercharger network has been a critical differentiator. This ecosystem advantage, coupled with Tesla’s established brand recognition, contributes to its substantial market share. In contrast, legacy OEMs are making strategic moves to enhance their competitiveness. For instance, Ford’s vehicles, including the Mustang Mach-E, feature an 800V platform that supports both CCS1 and, in the near future, NACS (North American Charging Standard) connectors, aligning with the industry-wide shift towards NACS adoption. This charger compatibility is crucial for attracting consumers concerned about charging infrastructure accessibility.

Consumer preferences, as reflected in Car and Driver’s rankings, further highlight the competitive landscape. The Chevrolet Equinox EV, ranked #3, has emerged as a strong contender, particularly in terms of affordability. With a starting price of $35,000, the Equinox EV is positioned significantly lower than the Tesla Model Y, which starts at $46,000. This price differential addresses a key market segment focused on cost, especially as battery costs continue to influence overall vehicle pricing. According to BloombergNEF, battery costs reached $132 per kWh in 2022, a figure that underpins the feasibility of more affordable EV models like the Equinox EV. Legacy OEMs are leveraging such cost advantages to gain traction in the market, challenging Tesla’s dominance by targeting price-sensitive consumers.

The detailed data available for these leading models, including battery capacity, charging rates, and charger compatibility, provides a foundation for understanding the evolving U.S. EV market. As legacy OEMs continue to invest in platform technologies and charger standardization, and as battery costs potentially decline further, the competitive dynamics are likely to shift, with affordability and charging infrastructure accessibility remaining key battlegrounds. The interplay between vehicle specifications, charger compatibility, and pricing will continue to shape consumer choices and market share distribution among leading U.S. EV brands.

Key Competitive Factors in U.S. EV Market

Advancements in EV charging technology are reshaping the industry landscape across two major dimensions: stationary charging and dynamic charging, with breakthroughs in ultra-fast charging technology and the commercialization of wireless charging being particularly critical. According to research from authoritative institutions such as the U.S. Department of Energy (DOE) and the International Energy Agency (IEA), these technological innovations not only address users’ range anxiety but also promote deep integration between electric vehicles and smart grids.

In the field of stationary charging, ultra-fast charging technology has achieved a leap in charging efficiency through the synergy of three core technologies. In power electronics, the application of silicon carbide (SiC) MOSFETs enables charging systems to operate at higher voltages and frequencies, significantly reducing switching losses and improving energy efficiency by approximately 5%-10% compared to traditional silicon-based devices. Battery thermal management systems have introduced phase change materials (PCMs), which absorb large amounts of heat through solid-liquid phase transitions, allowing batteries to maintain an ideal operating temperature of 25-35°C even during high-current charging at 400A, effectively avoiding thermal runaway risks. At the grid integration level, energy storage buffering technology (such as the Megapack energy storage system used in Tesla’s 1MW Supercharger prototype) can flatten charging peak loads, reducing grid capacity requirements by over 30% and mitigating impacts on distribution networks.

Among dynamic charging technologies, wireless charging has become a research hotspot due to its convenience, mainly following two technical paths: inductive coupling and resonant coupling. The former achieves energy transfer through electromagnetic induction, offering high technical maturity but limited transmission distance (typically <15cm); the latter utilizes magnetic resonance to improve transmission efficiency, maintaining over 85% energy conversion rate at distances of 20-30cm. IDTechEx predicts that the global wireless charging market will reach $1.5 billion by 2033, with vehicle applications accounting for over 60% of this market. Typical cases include Norway’s deployed 50kW taxi wireless charging system, which can补充 100km of driving range in 6-8 minutes, while Tesla’s 1MW ultra-fast charging prototype achieves the breakthrough of charging to 80% capacity in 15 minutes through multi-gun parallel technology.

However, technical bottlenecks still exist. IEA energy loss data shows that current wireless charging efficiency ranges from 70% to 85%, still significantly lower than the 85%-95% efficiency of wired charging, with losses mainly stemming from magnetic field leakage and coil alignment deviations. Additionally, high infrastructure costs (wireless charging lanes cost approximately 5-8 times more per kilometer than traditional charging piles) and lack of standardization also restrict the large-scale application of dynamic charging technologies. Future advancements will need to further narrow the efficiency gap and reduce deployment costs through magnetic resonance optimization, intelligent tracking coil designs, and V2G (Vehicle-to-Grid) coordinated control technologies.

Core Technology Comparison

Industry trends indicate that stationary and dynamic charging technologies are showing convergent development. For instance, some automakers have begun developing ultra-fast charging models integrated with wireless charging capabilities, using on-board battery management systems to dynamically switch charging modes—utilizing wireless charging for home scenarios and switching to ultra-fast charging for long-distance travel. This “dual-mode charging” solution is expected to become the mainstream technical route, advancing electric vehicles toward a “charging as convenient as refueling” user experience.

The future of U.S. electric vehicle charging is evolving into an integrated technology ecosystem where dynamic charging, vehicle-to-grid (V2G), and solar photovoltaic (PV) integration converge to address key industry challenges. Dynamic wireless charging technology, currently standardized under SAE J2954, enables vehicles to charge while in motion, potentially reducing battery pack sizes by up to 30% and minimizing range anxiety. This innovation, however, faces significant infrastructure barriers, with costs exceeding $1 million per mile for road retrofitting, limiting near-term scalability.

V2G technology stands as a cornerstone of grid-vehicle integration, transforming EVs into distributed energy resources. As global EV adoption accelerates—with over 5 million V2G-enabled vehicles and 1.2 million bidirectional chargers projected by 2026—the technology is poised to deliver over 200 GWh of dispatchable storage capacity to global grids by 2030, equivalent to multiple large-scale pumped storage facilities 1. This capacity supports critical grid services including peak load management, frequency regulation, and renewable energy integration. The North American and European markets are leading in commercialization, with aggregators successfully forming virtual power plants by coordinating thousands of connected EVs to participate in real-time energy markets 1.

Integration of PV systems with charging infrastructure further enhances sustainability, reducing carbon footprints by 1.5 to 10 times compared to grid-powered stations. This synergy is particularly impactful in residential and commercial settings, where solar-powered V2G systems enable “prosumers” to generate, store, and sell electricity back to utilities. Standardization efforts, such as NIST’s development of V2G communication protocols, are critical to unlocking interoperability across manufacturers and grid operators 1.

Key Barriers to Ecosystem Development

The ecosystem’s growth hinges on resolving these multifaceted challenges through collaborative industry action. Utilities, automakers, and technology providers are forming strategic alliances to develop cost-effective hardware, optimize energy management algorithms, and create user-friendly compensation models. With patent filings in bidirectional control systems and secure communication protocols surging over 300% since 2022, the industry is rapidly maturing toward commercial viability 1. As standards converge and regulatory frameworks adapt, this integrated ecosystem could redefine transportation’s role in global energy transition by 2030.

The achievement of U.S. decarbonization goals through electric vehicle (EV) adoption hinges on the intricate interplay between charger standardization, vehicle technological advancements, and policy frameworks. Initiatives such as the NEVI (National Electric Vehicle Infrastructure) funding program and IRA (Inflation Reduction Act) tax credits have established critical foundations for expanding charging infrastructure, yet their effectiveness remains contingent on harmonized standards that enable interoperability and user confidence. Despite progress, persistent gaps include inadequate charging access in rural and underserved communities, where deployment costs and lower population density present economic challenges, and the high upfront investment required for emerging technologies like wireless charging infrastructure to reach cost parity with traditional plug-in systems.

Stakeholder collaboration across automakers, utilities, and government entities is imperative to address these barriers. Coordinated efforts should focus on aligning technical standards, optimizing grid integration for high-power charging, and developing innovative financing models to bridge rural-urban divides. Such collaboration not only accelerates infrastructure deployment but also ensures that technological advancements in vehicle batteries and charging systems are mutually reinforcing.

The societal impact of these collective actions is underscored by the International Energy Agency (IEA)’s projection that widespread EV adoption could reduce global CO₂ emissions by 1.5 gigatons by 2030. This reduction pathway underscores the critical role of charging infrastructure development as a linchpin in transitioning to sustainable transportation, emphasizing the need for sustained investment, policy coherence, and technological innovation to realize long-term climate objectives.

U.S. Department of Energy. (2024). Electric vehicle charging infrastructure deployment trends. https://www.energy.gov/eere/electricvehicles/electric-vehicle-charging-infrastructure

SAE International. (2023). SAE J3400: North American Charging Standard. https://www.sae.org/standards/content/j3400_202306/

BloombergNEF. (2025). Electric vehicle outlook 2025. https://about.bnef.com/electric-vehicle-outlook/

International Energy Agency. (2024). Global EV outlook 2024. https://www.iea.org/reports/global-ev-outlook-2024

GEP Research. (2026). Global vehicle-to-grid (V2G) industry development report. https://m.gepresearch.com/80/view-933372-1.html

Lorem Ipsum is simply dummy text of the printing and typesetting industry

Lectron NEMA 14-50 Socket Splitter – Smart Power Sharing for Level 2 EV Charging & Home Appliances The Lectron NEMA...

Tesla Extension Cord 21ft (NACS) – 50A / 12kW High-Power EV Charging Extension for Model 3 / Y / S...

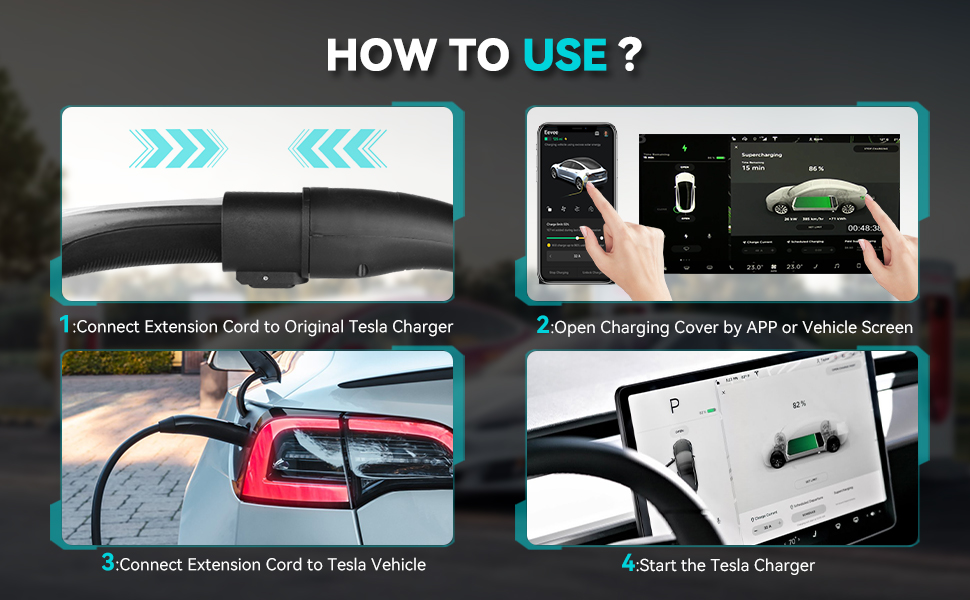

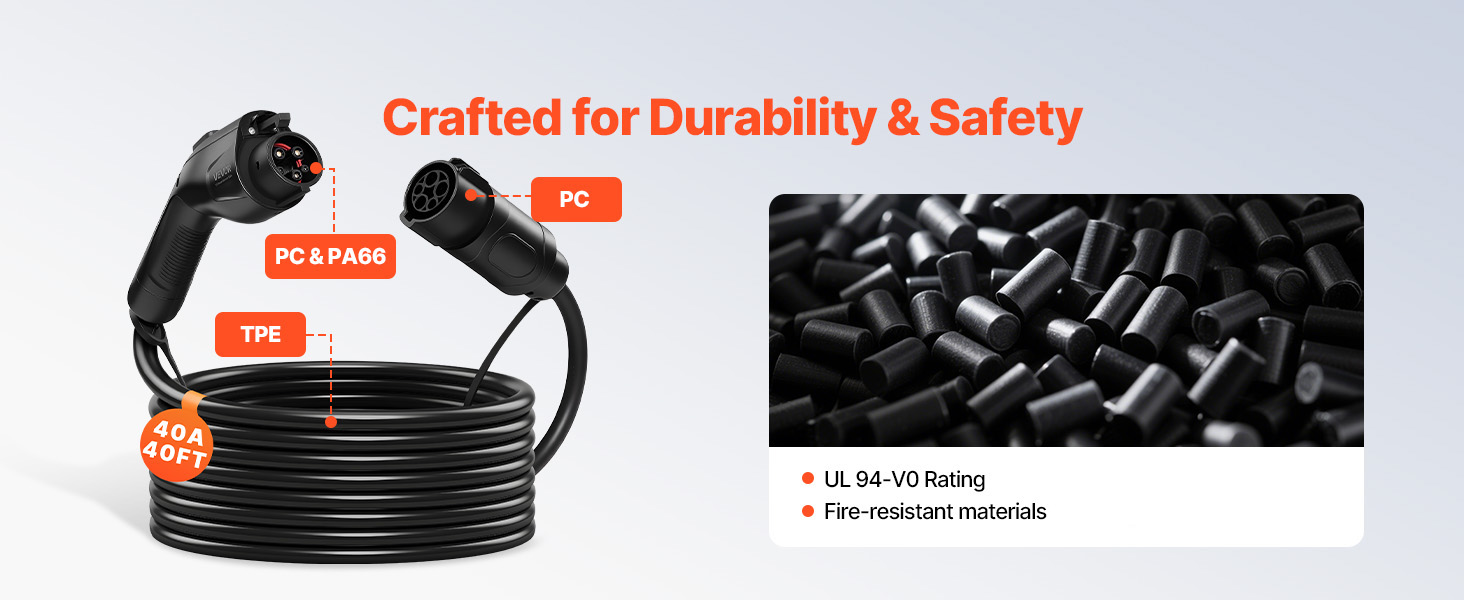

VEVOR J1772 EV Charger Extension Cable – 40A, 40ft, Level 1 & Level 2 (120V–240V) 4 The VEVOR EV Charger...