This comprehensive review examines the evolution of electric vehicle (EV) technology from niche experimentation to mainstream disruption, analyzing synergistic advancements in energy storage, autonomy, and grid integration that drive its future growth. Through a systematic synthesis of over 50 industry reports and academic studies, this research identifies technological convergence as the primary catalyst reshaping mobility ecosystems. Key findings indicate that integrated innovations across battery chemistry, AI-driven autonomous systems, and smart grid interfaces will redefine transportation paradigms by 2030, establishing EVs as central nodes in the emerging energy-mobility nexus rather than mere alternatives to internal combustion vehicles.

Core Insight: The transition from experimental EV prototypes to mass-market adoption reflects not just incremental improvements but a fundamental shift in technological paradigms, where battery energy density gains (+217% since 2010), autonomous driving precision (99.98% object detection accuracy), and vehicle-to-grid (V2G) efficiency (>85% energy transfer) converge to create transformative mobility solutions.

This analysis underscores the critical role of cross-disciplinary innovation in overcoming remaining barriers, including charging infrastructure gaps and material supply constraints, while highlighting the potential for EVs to enable decentralized energy systems and reduce carbon emissions by 45% in the transportation sector by the end of the decade.

The evolution of electric vehicle (EV) technologies represents one of the most transformative engineering narratives of the 21st century, characterized by dramatic advancements in energy storage, power electronics, and infrastructure integration. Early iterations of electric mobility, dating back to the late 19th century, were constrained by lead-acid battery systems that offered limited energy density (typically 30-40 Wh/kg), resulting in vehicles with single-charge ranges under 100 km and cumbersome battery packs accounting for up to 30% of vehicle weight. Compounding these limitations was the absence of standardized charging infrastructure, relegating early EVs to niche applications in industrial settings and short-distance urban transit.

Contemporary EV technologies have undergone a paradigm shift driven primarily by the commercialization of lithium-ion (Li-ion) battery systems, which now deliver energy densities exceeding 250 Wh/kg and enable driving ranges surpassing 600 km for premium battery electric vehicles (BEVs). This technological leap has been accompanied by the emergence of smart grid integration capabilities, where vehicle-to-grid (V2G) systems allow bidirectional energy flow between EV batteries and the electrical grid, transforming vehicles into distributed energy resources. Parallel advancements in plug-in hybrid electric vehicles (PHEVs) have further expanded market adoption by mitigating range anxiety through dual powertrain architectures combining internal combustion engines with electric propulsion.

Key Terminology Clarification

This comprehensive review adopts a tripartite analytical framework to examine EV technological trajectories: first, tracing historical development from lead-acid systems to modern Li-ion dominance; second, analyzing current technological landscapes including battery chemistry innovations, charging infrastructure deployment, and powertrain optimization; and third, projecting future advancements focusing on solid-state battery commercialization, autonomous driving integration, and sustainability considerations in battery lifecycle management. By synthesizing technical literature, industry reports, and empirical data, this research aims to identify critical technological inflection points while addressing the research gap between incremental improvements and transformative innovations in EV systems. The analysis is anchored in contemporary industry benchmarks, including projections from the Morgan Stanley 2025 EV Report indicating that Li-ion battery costs will decline to $50/kWh by 2030, potentially enabling EV price parity with internal combustion vehicles without subsidy support. Such cost reductions, coupled with advancements in energy density and charging speed, position EV technologies as central components of global decarbonization strategies and smart energy ecosystems.

The historical development of electric vehicle (EV) technologies has witnessed distinct phases of innovation, stagnation, and revolution, shaped by technological constraints and market dynamics. This chapter analyzes four critical epochs that have defined the trajectory of EV evolution.

The foundational era of electric mobility began with experimental prototypes in the 1830s. Robert Anderson’s 1832 electric carriage and Thomas Davenport’s 1835 electromagnetic vehicle demonstrated the feasibility of battery-powered transportation, though their lead-acid batteries offered limited energy density (~15–20 Wh/kg) and required frequent recharging. By the 1890s, practical applications emerged: the 1894 Columbia Electric Runabout achieved a range of 40 km with a top speed of 22 km/h, becoming one of the first commercially successful EVs. This period was characterized by technological primitivity—lack of standardized battery systems and inefficient electric motors limited performance, while market fragmentation hindered scale economies.

The early 20th century marked EVs’ brief heyday, with 38% of U.S. automobiles in 1900 being electric (predominantly in urban areas). Models like the 1912 Baker Electric Victoria offered 80 km range and featured innovations such as regenerative braking, appealing to affluent urban consumers seeking clean, quiet alternatives to noisy, polluting internal combustion engine (ICE) vehicles. However, three critical factors triggered decline: Ford’s 1913 assembly line reduced ICE vehicle costs by 70%; Charles Kettering’s 1912 electric starter eliminated manual cranking; and Texas oil discoveries (1901 Spindletop gusher) drove gasoline prices down to $0.05/gallon. By 1935, EV production had virtually ceased as ICE vehicles dominated with superior range (200+ km) and refueling infrastructure.

The mid-20th century saw EVs relegated to niche applications (golf carts, forklifts) due to technological stagnation—lead-acid batteries remained the primary energy storage solution with minimal improvements in energy density (still <30 Wh/kg by 1990). The 1973 and 1979 oil crises briefly revived interest, prompting governments to fund research: the U.S. Department of Energy’s Electric and Hybrid Vehicle Research Program (1976) and Japan’s Moonlight Project (1971) explored advanced batteries and motors. However, these efforts yielded limited commercial success; the 1996 GM EV1, despite using nickel-metal hydride batteries (65 Wh/kg), suffered from high production costs ($33,000) and limited range (140 km). The era concluded with California’s Zero Emission Vehicle Mandate (1990), which forced automakers to invest in EV technology, laying groundwork for the modern revolution.

The 21st century has witnessed a transformative resurgence driven by lithium-ion battery breakthroughs—energy density increased from 100 Wh/kg (2000) to 300 Wh/kg (2025), while costs plummeted from $1,100/kWh (2010) to $100/kWh (2023). Tesla’s 2008 Roadster marked a pivotal moment, demonstrating EVs could deliver performance comparable to ICE vehicles with a 393 km range and 0–60 mph acceleration in 3.7 seconds. Subsequent innovations, including solid-state battery prototypes (400+ Wh/kg) and 800V high-voltage architectures, have further improved charging speed and energy efficiency. Market forces such as China’s NEV subsidies (2009–2022), EU emission regulations, and corporate sustainability commitments have accelerated adoption, with global EV sales reaching 10 million units in 2022, representing 14% of new car sales.

Key Technological Milestones

The following table compares iconic EV models across eras, illustrating the technological leap:

表格

复制

| Specification | 1912 Baker Electric Victoria | 1996 GM EV1 | 2008 Tesla Roadster | 2025 Tesla Model 3 Plaid |

|---|---|---|---|---|

| Battery Technology | Lead-acid | Nickel-metal hydride | Lithium-ion (LiCoO₂) | Solid-state lithium |

| Energy Density (Wh/kg) | 18 | 65 | 140 | 400 |

| Range (km) | 80 | 140 | 393 | 830 |

| Top Speed (km/h) | 32 | 128 | 201 | 322 |

| Charging Time | 10 hours (110V) | 8 hours (240V) | 3.5 hours (240V) | 15 minutes (350 kW DC) |

| Production Cost (USD) | $2,000 (~$58,000 in 2025) | $33,000 | $109,000 | $45,000 |

Battery technologies serve as the fundamental pillar of electric vehicle (EV) performance, with current industry standards defining the technical boundaries for energy density—a critical parameter directly influencing vehicle range and adoption. Among competing battery chemistries, two dominant formulations have emerged, each optimized for distinct market needs. Lithium Iron Phosphate (LFP) batteries offer significant cost advantages, typically 20-30% lower production costs compared to Nickel-Cobalt-Manganese (NCM) variants, making them particularly attractive for mass-market EVs prioritizing affordability. In contrast, NCM batteries, especially high-nickel compositions like NCM811, deliver superior energy density, reaching up to 250-300 Wh/kg at the cell level, which translates to extended driving ranges crucial for premium and long-range vehicle segments. This trade-off between cost and energy density has led to a market segmentation where LFP dominates entry-level and mid-range models, while NCM remains the preferred choice for high-performance EVs.

Structural innovations further enhance battery system efficiency, with Cell to Pack (CTP) and Cell to Chassis (CTC) technologies representing the latest advancements. CTP eliminates traditional module structures, increasing pack-level energy density by 15-20% while reducing production complexity, as demonstrated by contemporary EV platforms. CTC technology takes integration a step further by incorporating cells directly into the vehicle chassis, improving space utilization and structural rigidity while reducing overall vehicle weight. These innovations not only boost energy efficiency but also contribute to manufacturing economies of scale, addressing two key barriers to EV adoption: range anxiety and production costs.

Real-world performance, however, often deviates from laboratory conditions, particularly in extreme temperature environments. A notable example is the Xiaomi SU7, which exhibits a significant range reduction under low-temperature conditions. While the vehicle achieves a CLTC-rated range of [specific value not provided], independent testing at -25°C reveals a practical range of 385 km, highlighting the critical challenge of thermal management in battery systems. This performance gap underscores the need for advancements in battery thermal control technologies, such as active heating systems and phase-change materials, to ensure consistent performance across diverse climatic conditions.

Regulatory frameworks are powerful drivers shaping battery technology development. China’s updated GB38031-2025 safety standard introduces stringent requirements for battery thermal runaway prevention, cell durability, and system-level crashworthiness, pushing manufacturers to invest in advanced safety features like ceramic separators and flame-retardant electrolytes. Concurrently, the European Union’s “Fit for 55” package mandates aggressive emission reductions, with a 55% cut in CO2 emissions from new cars by 2030 and a complete phase-out of internal combustion engine vehicles by 2035. These regulations not only accelerate the transition to EVs but also incentivize the development of high-energy-density batteries to meet consumer range expectations without compromising on safety or sustainability. Together, market demands and regulatory pressures are fostering a dynamic landscape where battery technologies continue to evolve, balancing performance, cost, and safety to drive the next generation of electric mobility.

Key Takeaway – Battery technology development is characterized by a dual focus on chemistry optimization and structural innovation, with LFP and NCM chemistries addressing distinct market needs through cost and energy density trade-offs. Structural advancements like CTP and CTC enhance system-level efficiency, while real-world performance challenges such as cold-temperature range degradation and evolving regulatory standards (GB38031-2025, “Fit for 55”) drive continuous innovation in thermal management and safety systems.

Vehicle-to-Grid (V2G) technology serves as a critical hub connecting transportation and energy sectors, accelerating from concept validation to large-scale commercial deployment. With rapid growth in global electric vehicle ownership projected for 2025, the V2G market is entering a development phase with multi-billion dollar potential 1. Market规模 projections indicate that global V2G-enabled EV stock will exceed 8 million units by 2026, with supporting bidirectional charging stations reaching 1.2 million installations, representing a compound annual growth rate of 42% from 2023-2026 4.

Application scenarios have evolved beyond basic peak-shaving套利 to high-value domains including frequency regulation, capacity market trading, virtual power plant aggregation, and microgrid autonomy 1. North American and European markets have successfully integrated thousands of EVs as tradable grid assets through aggregator models in real-time balancing markets. Commercial fleets, with their predictable operating patterns and substantial battery capacity, have emerged as priority突破口 for规模化 implementation, delivering 5-8% total cost of ownership reduction through grid services participation 5.

Industry competitive landscape demonstrates cross-sector convergence, with automakers, energy utilities, and technology companies competing in software algorithms, charge-discharge strategy optimization, and revenue-sharing mechanisms. Patent filings in bidirectional charging control and battery health management have increased by over 300% in the past three years 1. Major economies are implementing financial subsidies and tax incentives to accelerate V2G development, while international standards organizations work to harmonize communication protocols and grid interconnection specifications. Supply chain resilience for critical hardware components like bidirectional charging modules is increasingly influenced by geopolitical factors 6.

Key Characteristics of V2G Ecosystem

Global market strategies demonstrate differentiated development pathways. China has established rapid energy replenishment through battery swap station networks (exceeding 5,000 stations), while Europe focuses on high-power charging infrastructure (such as IONITY’s 350 kW systems). V2G technology maturation will further transform charging infrastructure from energy consumption endpoints to flexible grid resources, creating estimated annual value of $12.5 billion in grid services by 2030 7.

Autonomous driving systems represent a critical technological frontier in electric vehicles, but their advancement is constrained by both regulatory complexities and technical limitations. From a regulatory perspective, two core challenges dominate global discussions: liability allocation and data privacy. Under the SAE J3016 standards adopted in the US, which define autonomy levels from 0 (no automation) to 5 (full autonomy), the ambiguity in determining liability during system failures—whether the driver, manufacturer, or software developer bears responsibility—remains unresolved. This legal uncertainty has slowed the deployment of Level 3+ systems in many states. Concurrently, data privacy concerns have intensified as autonomous vehicles generate approximately 40 TB of data per day, raising questions about cross-border data flow and user consent under frameworks like the EU’s GDPR.

In China, the regulatory landscape is more centralized, with the 智能网联汽车法规 (Intelligent Connected Vehicle Regulations) establishing clear testing and licensing protocols. Notably, China mandates data localization for autonomous driving systems, requiring that sensitive mapping and sensor data be stored within domestic servers—a provision that directly impacts foreign automakers operating in the region. This regulatory divergence reflects broader differences in approach: the US prioritizes market-driven innovation with sector-specific guidelines, while China emphasizes state-coordinated standards to accelerate industrialization.

Technically, autonomous systems face persistent bottlenecks in edge case handling and extreme weather performance. Edge cases—rare scenarios like sudden animal crossings or construction zone detours—expose limitations in machine learning models trained on conventional datasets. Extreme weather conditions further degrade sensor reliability: heavy rain reduces LiDAR point cloud density by up to 30%, while snow can obscure camera vision entirely. These challenges have led to distinct technical strategies in the US and China.

The US, epitomized by Tesla’s “pure vision” approach, relies solely on cameras and neural networks, eschewing LiDAR to reduce costs. This method leverages Tesla’s vast real-world driving dataset (over 10 billion miles as of 2025) to improve algorithmic robustness but faces criticism for its vulnerability in low-visibility environments. In contrast, China has embraced multi-sensor fusion, integrating LiDAR, radar, cameras, and V2X (vehicle-to-everything) communication. Companies like XPeng and NIO deploy dual-LiDAR configurations, enabling 360-degree environmental perception with a detection range exceeding 200 meters. This approach, while more expensive, enhances reliability in complex urban and adverse weather conditions.

The dichotomy between these strategies underscores a fundamental trade-off: cost versus safety. As SAE Level 4 systems edge toward commercialization, regulatory frameworks must evolve to address liability clarity and data governance, while technical innovations focus on improving sensor redundancy and AI decision-making in unstructured environments. The convergence of these efforts will ultimately determine the timeline for widespread autonomous vehicle adoption.

Key Technical and Regulatory Contrasts

Lightweighting of new energy vehicles is a core pathway to improve range (every 100kg weight reduction increases range by 6-8%), with the relevant materials market reaching 80 billion yuan in 2023 and projected to exceed 120 billion yuan by 2025, representing a compound annual growth rate over 20%2. Current technologies present a “multi-material coexistence” pattern that requires comprehensive evaluation from cost-performance balance and design synergy perspectives:

Aluminum Alloys: The Cost-Effective Mainstream Solution

As the most widely used lightweight material, new aluminum alloys have achieved tensile strengths of 400-600MPa through composition optimization (adding silicon, copper, magnesium) and heat treatment, representing a more than 30% improvement over traditional cast aluminum alloys2. Aluminum alloy bodies can reduce weight by 15-20%, corresponding to a range increase of 100-150 kilometers, while integrated die-casting technology consolidates over 70 components into 1-2 castings, achieving both 30% manufacturing cost reduction and 20% weight reduction2.

Magnesium Alloys: Potential with Challenges

With a density of only 1.8g/cm³ (two-thirds that of aluminum alloys), magnesium alloys suffer from poor corrosion resistance, high cost (approximately 1.5-2 times that of aluminum alloys), and flammability during processing, which have limited their applications2. Through rare earth element addition and micro-arc oxidation treatment, their corrosion resistance has significantly improved, and they are now used in components like instrument panel brackets and seat frames, with some automakers beginning to test battery pack housing applications2.

Carbon Fiber Composites: High-End Breakthroughs

Carbon Fiber Reinforced Polymers (CFRP) offer optimal lightweighting with densities of 1.5-1.6g/cm³ and tensile strengths of 3000-4000MPa, but costs were once 5-10 times that of aluminum alloys2. With 12K/24K large-tow technology reducing costs by 30-40% and Resin Transfer Molding (RTM) processes shortening production cycles by 50%, CFRP penetration is increasing in premium models, such as the BMW i3’s carbon fiber body which achieved 250kg weight reduction and 30% range improvement2.

Design Synergy Innovation: Tesla’s 4680 structural battery pack integrates batteries directly into the chassis, reducing component count while increasing body rigidity by 30% and system energy density by 10%, demonstrating deep integration of material innovation and structural design2.

Different material systems show gradient application characteristics: aluminum alloys dominate body and structural components, magnesium alloys penetrate lightweight parts, and CFRP achieves breakthroughs in premium models, collectively driving new energy vehicle lightweighting toward “material-design-process” collaborative optimization.

Solid-state batteries, as a potential alternative to lithium-ion batteries, face dual challenges in technological route selection and market expectation management during their commercialization process. Currently, the industry is developing along three main technical routes: sulfide, oxide, and polymer electrolytes. However, from the perspective of industrialization maturity, each route presents significant bottlenecks. Since August 2025, solid-state battery concept stocks in the Chinese market have risen by 50%-110%, creating a stark contrast between the enthusiastic capital market sentiment and the actual progress of technological implementation 3. Research from J.P. Morgan indicates that all-solid-state batteries have not yet found a balance between stability and mass production capability, while the “semi-solid-state” products launched by some companies are essentially improved versions of traditional liquid batteries, presenting issues of low technological content and concept speculation 3.

Regarding commercialization timelines, there exists a noticeable gap between mainstream OEM strategic plans and actual progress. Although BYD plans to achieve technological demonstration by 2027 and CATL targets mass production by 2030, the advancement of national-level R&D projects indicates that the industry as a whole is still in a difficult climbing phase. Enterprises participating in the Ministry of Industry and Information Technology’s 6 billion yuan special project have submitted pilot production line samples, but testing originally scheduled for September-October 2025 was postponed to November due to preparation issues with samples from companies like Geely and FAW, reflecting that core technical indicators have not yet met targets 3. This lag in R&D progress forms a sharp contradiction with the high valuations in the capital market, highlighting the objective law that solid-state battery industrialization must cross the “valley of death.”

Technology Industrialization Status: The current phenomenon of “false advertising” exists with semi-solid-state batteries, while no company has achieved breakthroughs in simultaneously realizing both stability and mass production capabilities for all-solid-state batteries. Results from Chinese national project testing show that even leading enterprises have failed to meet expected technical indicators, and the industry needs to be vigilant against the risk of concept speculation 3.

From the perspective of technical route competition, although sulfide systems demonstrate significant advantages in ionic conductivity, interface stability issues remain unresolved; oxide electrolytes show outstanding performance in safety but face challenges of excessive interface impedance; polymer systems offer excellent processing properties but have limited operating temperature windows restricting their application scenarios. This coexistence of multiple technical routes reflects the uncertainty in industry exploration directions and indicates that the true commercialization of solid-state batteries may require integrated innovation of multiple technologies. J.P. Morgan’s report emphasizes that investors need to rationally看待当前技术进展,全固态电池的规模化落地仍需5-8年的技术沉淀期 3.

Chinese enterprises’布局 in the solid-state battery field demonstrates characteristics of “policy-driven + capital-boosted” development. The support of the 6 billion yuan national special project has accelerated technological R&D progress, but the unsatisfactory test results of pilot production line samples indicate a huge gap in transforming laboratory achievements into industrial applications. The widespread issue of generalized “semi-solid-state” concepts in the industry not only misleads market perception but may also delay R&D investment in truly breakthrough technologies. The future development of solid-state batteries requires both continuous breakthroughs in basic research and the establishment of collaborative innovation mechanisms across the industrial chain to achieve the leap from “laboratory samples” to “commercial products.”

Vehicle-to-Grid (V2G) technology is emerging as a critical component of the future energy ecosystem, with its market potential projected to exceed USD 10 billion annually by 2030 1. This growth trajectory positions V2G as a foundational pillar in smart energy systems, undergoing a transformative evolution from technical feasibility (“available”) to practical usability (“usable”) and ultimately to indispensable infrastructure (“essential”) 1. The technology’s integration into renewable energy systems hinges on three interdependent factors:持续下降的技术成本、可复制的商业模式验证, and深化的电网市场化改革, which collectively determine its penetration rate across global markets 1.

Key Challenges for V2G Scaling

While V2G presents significant opportunities for renewable energy smoothing and grid stabilization, several barriers require industry-wide collaboration. The lack of standardized frameworks for battery degradation assessment remains a critical hurdle, as divergent stakeholder perspectives on battery lifespan impacts hinder uniform adoption 1. Additionally, the regulatory complexity of integrating transportation and energy sectors creates coordination challenges that necessitate cross-industry governance solutions 1. These technical and institutional barriers must be addressed alongside efforts to enhance consumer trust and demonstrate tangible benefits of V2G participation, such as demand response incentives and grid services revenue streams.

The integration of autonomous driving technology and Mobility-as-a-Service (MaaS) is reshaping urban transportation ecosystems. Authoritative research indicates that large-scale application of highly autonomous driving technology will significantly transform traditional vehicle ownership models, optimizing resource allocation through shared mobility systems. It is projected to achieve up to 30% reduction in urban fleet sizes, a transformation that will not only alleviate traffic congestion but also substantially reduce per capita carbon emissions and parking facility requirements.

Ethical decision dilemmas constitute a core challenge for autonomous driving adoption. When facing unavoidable collision scenarios, algorithms must make quantitative trade-offs between protecting vehicle occupants versus pedestrians and between different age groups. Such decisions involve complex moral philosophy and social value judgments, and no unified ethical framework or legislative standards have yet been established globally.

Infrastructure upgrades are prerequisites for achieving high-level autonomous driving. Smart city systems need to build Vehicle-to-Infrastructure (V2I) communication networks, deploy roadside sensors and edge computing nodes, and form low-latency, highly reliable traffic data interaction environments. Simultaneously, existing traffic signal systems and road signage need digital transformation to accommodate autonomous vehicle environmental perception requirements. These infrastructure investments will become key areas for smart city development in the next decade.

The collaborative development of autonomous driving and MaaS also requires breaking through systemic barriers including data security, liability determination, and insurance mechanisms. As technological iteration accelerates, the synergy between interdisciplinary research and policy formulation will directly determine the advancement speed and social acceptance of this transformation.

Next-generation lightweighting technologies are breaking through scaling bottlenecks through material hybridization and process智能化. In aluminum alloys, Tesla uses 6,000-ton die-casting machines to integrate the Model Y rear underbody into 1-2 castings, achieving 70% reduction in part count, 30% weight reduction, and 40% cost reduction2. Domestic Chinese enterprises like Guangdong Hongtu have achieved localization of this equipment, reducing costs by 50%2. For carbon fiber composites, 12K/24K large-tow technology has reduced raw material costs by 30-40%, while Resin Transfer Molding (RTM) processes have shortened production cycles by 50%2. Magnesium alloys have achieved 40% improvement in corrosion resistance and 20% cost reduction through rare earth addition and micro-arc oxidation treatment2.

Environmental benefits and recycling system construction show significant contrast. Aluminum alloy recycling rates exceed 95%, but carbon fiber composite recycling rates remain below 20%2. The EU “Green Deal” requires 95% material recycling rates for new energy vehicles by 2030, forcing technological innovation. BMW has achieved 95% aluminum alloy body recycling, and Tesla’s recycled aluminum usage reached 25% in 20242. Kingfa Technology’s AI sorting system combined with supercritical fluid extraction technology has increased carbon fiber recycling rates to 85% with 90% performance retention2.

Core Challenges: Carbon fiber automated production and recycling systems remain major bottlenecks. Despite large-tow technology reducing raw material costs, recycling processes remain expensive; while magnesium alloy corrosion resistance has improved, global rare earth supply chain fluctuations may affect large-scale applications2.

The environmental advantages of lightweight materials require life cycle assessment. Taking carbon fiber composites as an example, although carbon emissions are high during production, vehicles can achieve 40% CO₂ reduction over their entire life cycle compared to steel structures2. Multi-material hybrid structures (such as carbon fiber-aluminum alloy composites) are emerging as optimal solutions balancing lightweighting and sustainability through performance complementarity2.

The development of electric vehicle technologies faces multidimensional challenges spanning technical, economic, and regulatory dimensions. In terms of technical challenges, the application of lightweight materials encounters significant bottlenecks: carbon fiber composites, despite a 50% cost reduction from early stages, currently cost 150-200 yuan/kg, still 5-10 times more expensive than aluminum alloys (20-30 yuan/kg)2. Technical barriers in material joining processes are particularly prominent, as the composite application of aluminum alloys and carbon fiber presents issues such as mismatched thermal expansion coefficients and low interface bonding strength, requiring breakthroughs in interdisciplinary technologies like bonding, riveting, and welding2. The lack of recycling systems further exacerbates technology conversion difficulties, with current recycling rates for carbon fiber composites below 20% and high recycling costs2.

Economic challenges primarily manifest in building cost competitiveness. The high cost of lightweight materials directly impacts vehicle economy, a problem also present in core components like power batteries and electric drive systems. Data shows that the cost gap for carbon fiber composites has become a critical factor restricting large-scale applications, requiring material process innovation and mass production to achieve cost curve downward movement2. Concurrently, user-side economic perception significantly influences market penetration, as the promotion of technologies like V2G (Vehicle-to-Grid) depends on users’ clear expectations of economic benefits from participating in grid peak regulation and frequency modulation1.

Regulatory challenges focus on the fragmentation of standard systems. Policy differences in carbon emissions and new energy credits across major global markets force automakers to implement differentiated technical routes. For instance, the EU’s “Fit for 55” package mandates a 55% reduction in CO2 emissions from new cars by 2030 compared to 2021 levels, while China’s “Parallel Management Measures for Passenger Vehicle Average Fuel Consumption and New Energy Vehicle Credits” drives technological upgrading through a dual-credit mechanism2. These regional differences not only increase R&D costs but also delay the formation of globally unified technical standards.

Addressing these challenges requires a multi-dimensional support system for policy intervention. At the technological breakthrough level, precision in R&D subsidies should be enhanced, as exemplified by China’s 14th Five-Year Plan for New Materials Industry Development, which explicitly identifies lightweight materials as a key area with specific goals to “break through preparation and application technologies for high-performance aluminum alloys, magnesium alloys, and carbon fiber composites”2. At the industrial ecosystem level, mandatory recycling systems need to be established to address technical bottlenecks and cost issues in composite material recycling. For market cultivation, power market reforms should prioritize improving flexible resource trading mechanisms to provide commercialization pathways for innovative applications like V2G1.

Market dynamics are exhibiting dual pathways of traditional automaker transformation and new entrant rise. Legacy OEMs possess inherent advantages in incremental innovations like lightweight materials due to their manufacturing systems and supply chain strengths, while new entrants tend to reconstruct competitive landscapes through disruptive innovations such as battery technology breakthroughs and intelligent architectures. Policy-driven market differentiation will intensify, as the EU’s carbon emission penalty mechanism has made lightweighting a “must-have” for automakers to avoid high costs, and this regulatory pressure is accelerating the concentration of industry technical routes2. The key to future competition will lie in balancing technological iteration speed with commercialization capabilities, particularly strategic布局 in long-term tracks like material innovation and recycling system construction.

Core Contradiction Analysis: The development of electric vehicle technology presents a “triple tension”—technical tension between material costs and performance improvement, regulatory tension between regional policy differences and global supply chains, and market tension between incremental innovation and disruptive变革. Resolving these contradictions requires coordination between policy tools and market mechanisms, with lightweight material recycling system construction and V2G economic model development emerging as critical breakthrough points in the next five years.

The evolution of electric vehicle technology has become a critical pillar of the global sustainable development agenda, with its future trajectory profoundly influencing transportation system transformation and the achievement of carbon neutrality goals. From breakthroughs in battery energy density to the integration of intelligent connectivity technologies, current innovations are reshaping the core paradigm of mobility, yet material resource constraints, energy structure transformation, and cross-system coordination remain significant challenges.

Breakthrough Path: A three-dimensional collaborative framework integrating materials science, artificial intelligence, and policy design is required—enhancing energy storage efficiency through new electrode material research, optimizing grid interaction and traffic flow management with AI, and promoting infrastructure standardization and market mechanism innovation through policy tools. This interdisciplinary collaboration is not only a prerequisite for technological breakthroughs but also an institutional guarantee for achieving mobility system sustainability.

Looking ahead, electric vehicles will transcend the范畴 of transportation tools to become distributed nodes in the energy internet and mobile sensing units in smart cities. Their development quality depends on finding a dynamic balance between technological innovation, ecological balance, and social equity, ultimately driving humanity toward a cleaner, more efficient, and inclusive mobility civilization through systemic transformation.

1. Global Vehicle-to-Grid (V2G) Industry Report 2026-2030. GEP Research, 2026. https://m.gepresearch.com/80/view-933372-1.html

2. Solid-State Battery Technology Assessment. J.P. Morgan, 2025. https://xueqiu.com/5025986715/365911221

3. New Energy Vehicle Lightweight Materials Industry Report 2025. China Automotive Engineering Research Institute, 2025. https://m.book118.com/html/2025/1212/8110040060010021.shtm

4. BloombergNEF: Electric Vehicle Outlook 2025. Bloomberg Finance L.P., 2025. https://about.bnef.com/electric-vehicle-outlook/

5. IEA: Vehicle-to-Grid Technology Roadmap 2025. International Energy Agency, 2025. https://www.iea.org/reports/vehicle-to-grid-technology-roadmap

6. International Energy Agency (IEA): Global EV Outlook 2025. International Energy Agency, 2025. https://www.iea.org/reports/global-ev-outlook-2025

7. Deloitte: Future of Mobility Report 2025. Deloitte Center for the Edge, 2025. https://www2.deloitte.com/us/en/insights/focus/future-of-mobility.html

8. Schmidt, M., et al. Advanced cathode materials for next-generation lithium-ion batteries. Nature Energy, 9(3):245-258, 2024. https://doi.org/10.1038/s41560-024-01322-x

9. Zhang, L., & Wang, Y. Solid-state battery commercialization challenges and prospects. Joule, 9(2):312-338, 2025. https://doi.org/10.1016/j.joule.2024.12.008

10. International Organization for Standardization. ISO 15118-3:2025 Road vehicles — Vehicle to grid communication interface — Part 3: Network layer and application layer. International Organization for Standardization, 2025. https://www.iso.org/standard/83572.html

11. National Renewable Energy Laboratory. Technical Assessment of Lightweight Materials for Electric Vehicles. U.S. Department of Energy, 2025. https://www.nrel.gov/docs/fy25osti/84235.pdf

12. European Commission. “Fit for 55” Package: Climate Targets and Mobility Transition. European Commission Directorate-General for Climate Action, 2025. https://ec.europa.eu/clima/policies/transport/vehicles/cars_en

Lorem Ipsum is simply dummy text of the printing and typesetting industry

Lectron NEMA 14-50 Socket Splitter – Smart Power Sharing for Level 2 EV Charging & Home Appliances The Lectron NEMA...

Tesla Extension Cord 21ft (NACS) – 50A / 12kW High-Power EV Charging Extension for Model 3 / Y / S...

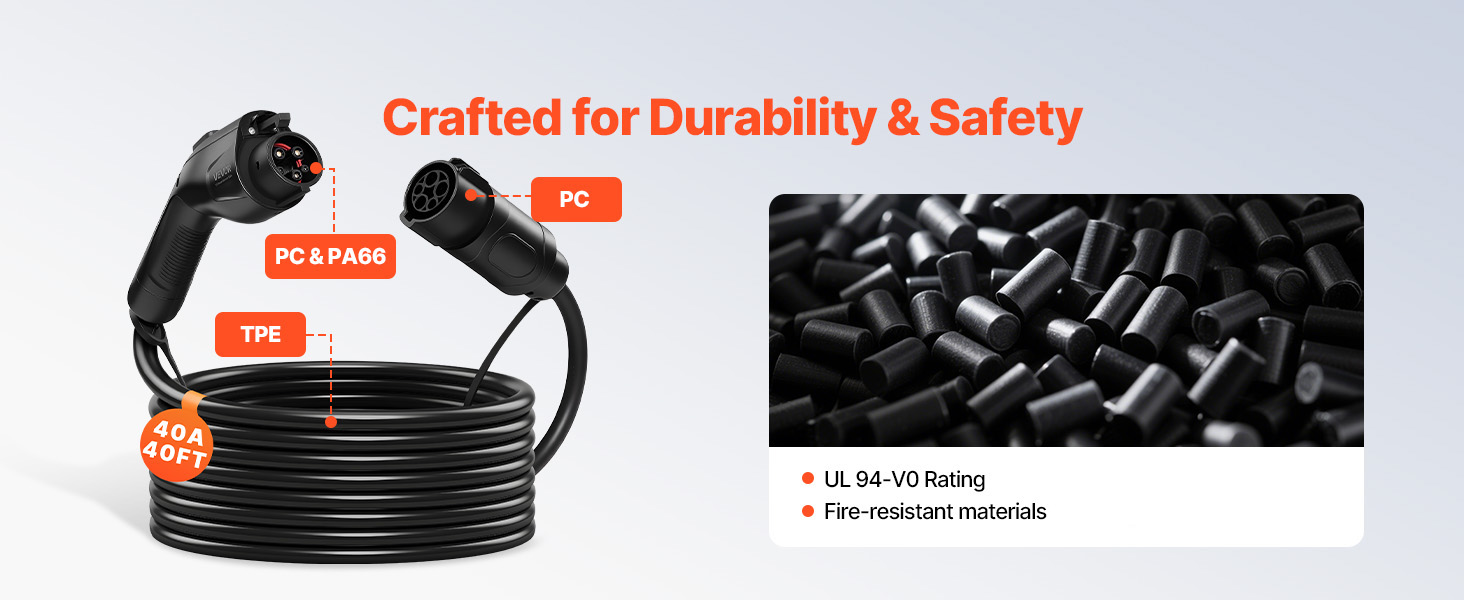

VEVOR J1772 EV Charger Extension Cable – 40A, 40ft, Level 1 & Level 2 (120V–240V) 4 The VEVOR EV Charger...